Fresh bears probe below daily cloud as concerns about supply disruption ease

WTI oil price fell to five-week low at $68.08 on Tuesday, amid nervous market sentiment ahead of US sanctions against Iran start early Nov, as Saudi Arabia said it will keep markets supplied on supply shortage once Iran’s exports stop.

Saudi Arabia said it will play responsible role in energy markets despite rising pressure and isolation on death of Saudi journalist.

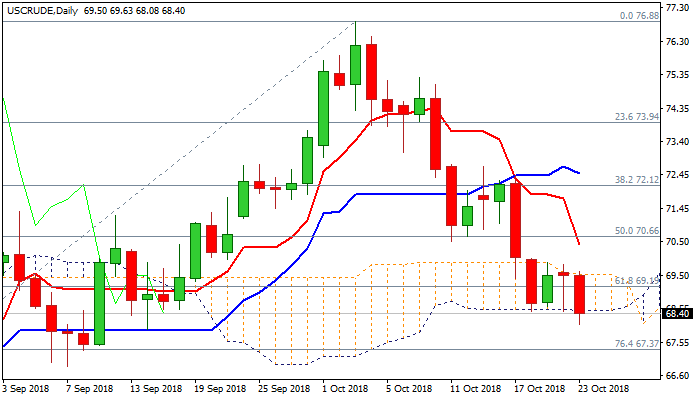

Fresh weakness generated bearish signal on probe below daily cloud base ($68.48) after the action in past three days was moved within the cloud (spanned between $68.48 and $69.55).

Negative sentiment on easing fears of reduced supply is boosted by bearish daily techs which maintain strong bearish momentum for further weakness.

Close below daily cloud base would be negative signal for extension towards next strong support at $67.44 (200SMA) also near Fibo 76.4% of $64.43/$76.88).

Releases of US crude inventories (API report is due later today and EIA report will be released on Wednesday) will be closely watched for fresh signals.

Res: 69.19; 69.57; 69.90; 70.51

Sup: 68.08; 67.93; 67.44; 66.85