Fresh easing signals that recovery phase might be over

The pair fell back to 109.50 zone (approx. the mid-point of this week’s range) on fresh safe-haven buying as markets fear an escalation of US/China trade tensions after China signaled a lack of interest in resuming trade talks with the US under current circumstances.

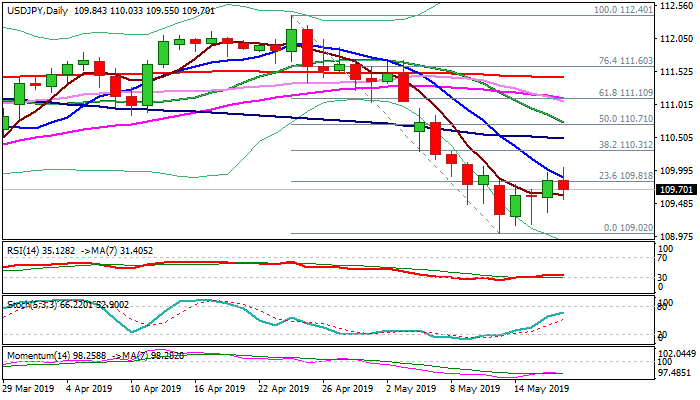

Recovery attempts from week’s low at 109.02 (supported by formation of bear-trap pattern on daily chart) ran out of steam at 110.00 zone, where repeated upside rejections occurred.

The barrier is reinforced by falling daily Tenkan-sen and guards more significant 110.31 resistance (daily cloud base / Fibo 38.2% of 112.40/109.02).

Near-term risk is expected to shift lower while the price remains below 110, with fresh weakness threatening of renewed attempt below cracked 109.41 pivot (Fibo 38.2% of 104.57/112.40).

Weekly close below here is needed to generate bearish signal for extension of bear-leg from 112.40 (2019 high, posted on 24 Apr).

Bearish momentum is gaining pace, with bearish setup of daily Tenkan-sen / Kijun-sen, supporting scenario.

Only sustained break above 110.31 would neutralize downside risk and shift near-term focus higher.

Res: 109.87; 110.00; 110.31; 110.48

Sup: 109.55; 109.33; 109.02; 108.49