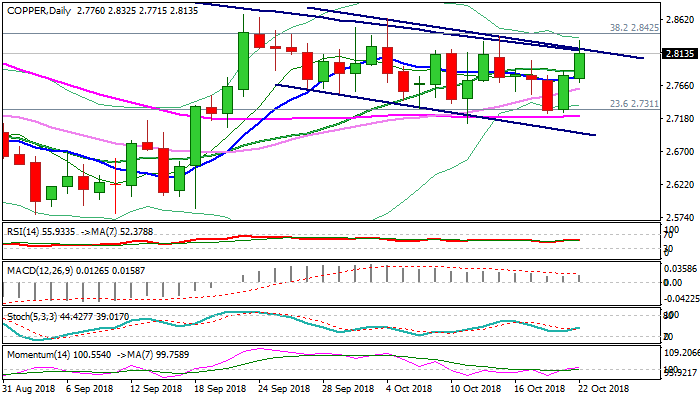

Fresh rally on strong fundamentals struggles to clear falling 100SMA barrier

Copper maintains firm tone and advances for the second day, hitting one-week high at $2.8325 on Monday.

The metal price rallied on rising expectations of stronger demand from world’s top consumer China.

Bounce from $2.7250 zone, where 55SMA contained multiple downside attempts, cracked important barrier at $2.8167 (falling 100SMA), which kept upside attempts during past five weeks limited.

Fresh advance needs close above 100SMA to generate bullish signal for extension towards highs at $2.8645 (04 Oct) and $2.8695 (21 Sep), which mark key short-term barriers and guard the base of thick weekly cloud ($2.8960).

Daily MA’s (10/20/30) turned to bullish setup and support the advance along with bullish momentum, but failure to clear 100SMA would keep the price within short-term bear-channel and keep risk of fresh weakness alive.

Converging daily SMA’s – 20 ($2.7865) and 10 ($2.7815), mark pivotal support and break lower would weaken near-term structure.

Res: 2.8167; 2.8325; 2.8465; 2.8695

Sup: 2.8035; 2.7715; 2.7616; 2.7250