Fresh recovery above converged MA’s sidelines downside risk

WTI oil price ticks higher on Monday, supported by renewed concerns about US/China trade conflict and persisting concerns about the impact of sanctions on Iran.

On the other side, rise in global supply weighs on oil prices, as report on Thursday showed record of 100 million barrels per day.

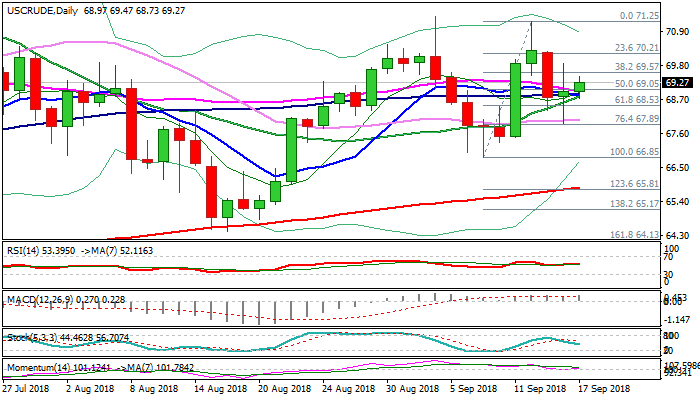

Fresh recovery attempts after last Thursday’s strong fall and Friday’s long-legged Doji, signal formation of reversal pattern on daily chart.

Fresh advance pressures top of daily cloud ( $69.46) which is widening after twisting last Friday, with close above cloud needed to neutralize risk of renewed attack at 30SMA support ($68.04) and shift near-term focus higher.

Lift above converged daily MA’s (20/100/10/55) and 14-d momentum emerging from negative territory and forming bull-cross, would support further recovery.

Res: 69.57; 69.89; 70.00; 70.26

Sup: 68.46; 68.34; 68.04; 67.48