Fresh risk mode boosts pound but risk of deeper pullback exists

Cable traded in a narrow range and without clear direction in Asian session on Monday, but holds near-term bullish bias following gap-higher opening at the beginning of the week.

Receding concerns about no-deal Brexit, President Trump’s criticism of the Fed and high dollar, as well as optimism over US/China trade deal boosted risk appetite and improved pair’s sentiment.

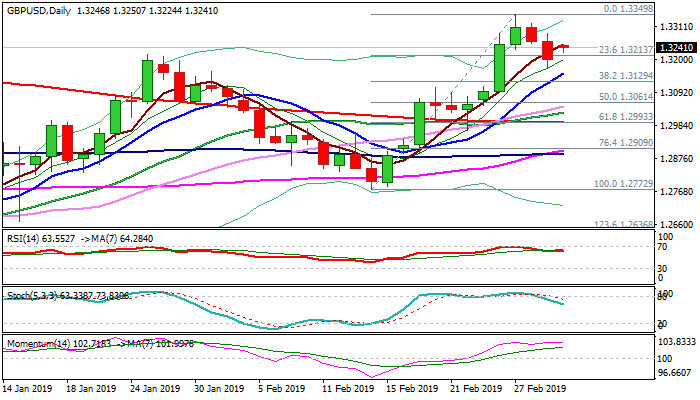

Two-day pullback from new high at 1.3349 found footstep at 1.3172, keeping pivotal supports at 1.3155 (10SMA) and 1.3129 (Fibo 38.2% of 1.2772/1.3349) intact and reducing risk of deeper pullback for now.

Last week’s strong bullish close (the second straight bullish week) and firmly bullish weekly techs are supportive factors, however, failure at weekly cloud base (1.3265) and weekly close below cloud after strong upside rejection, weighs and keeps in play risk of fresh weakness.

Fresh bulls pressure rising daily 5SMA (1.3252) break above which would generate fresh bullish signal and keep near-term focus shifted higher.

Highs of last Fri./Thu (1.3286 / 1.3319 respectively) mark next targets ahead of key barrier at 1.3349 (27 Feb high), break of which would signal bullish continuation.

Conversely, violation of 1.3155/29 pivots would signal deeper correction of 1.2772/1.3149 upleg.

Res: 1.3253; 1.3286; 1.3319; 1.3349

Sup: 1.3213; 1.3172; 1.3155; 1.3129