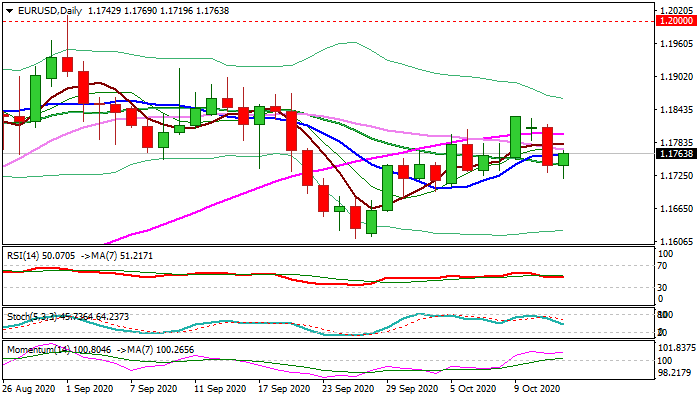

Fresh weakness faces strong headwinds at key Fibo support

The Euro bounces after attempts to extend Tuesday’s nearly 0.6% drop, dented Fibo support at 1.1721 (50% retracement of 1.1612/1.1830 upleg) but faced strong headwinds.

Although the most recent bull-trap above Fibo 50% of 1.2011.1.1612 and Wednesday’s big bearish daily candle weigh, today’s action is forming bull hammer candle which could be an initial signal that near-term bears lost traction and focus is shifting higher.

Fresh recovery attempt needs daily close above converged daily Tenkan-sen / Kijun-sen at 1.1763 (which also attempt to form bull-cross) for confirmation. Daily techs are mixed and lack clearer direction signal, but evident rising of positive momentum underpins the action for now.

Lift above 1.1763 would expose key barriers at 1.1811/30 (Fibo 50% / last Friday’s high), with clear break here to signal continuation of recovery from 1.1612 (25 Sep low).

Conversely, failure to close above 1.1763 pivot would keep the downside vulnerable and risk extension of pullback from 1.1830 high (9 Oct).

Res: 1.1775; 1.1788; 1.1811; 1.1830

Sup: 1.1747; 1.1721; 1.1695; 1.1663