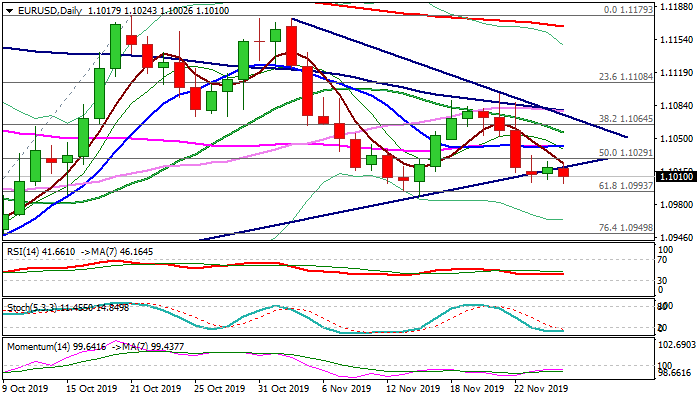

Fresh weakness on trade optimism pressures again key 1.10 support zone

The Euro eased in early Wednesday’s trading after comment from President Trump overnight that the US and China are close to reach a deal.

Fresh optimism lifted dollar and erased all gains of pair’s brief recovery on Tuesday, shifting near-term focus towards key support zone at 1.1000/1.0989 (psychological support / Fibo 61.8% of 1.0878/1.1179 / 14 Nov low).

Bears still face strong headwinds here as oversold daily stochastic and improving momentum reduce pressure for now.

Lower volumes in pre-Thanksgiving holiday trading also contribute to scenario of extended narrow-range sideways trading which extends into fourth straight day.

Break and close below 1.1000/1.0989 pivot (following false break on 14 Nov) would generate bearish signal for extension of the downtrend from 1.1179/75 double-top towards supports at 1.0949 (Fibo 76.4%) and 1.0940 (8 Nov trough).

Conversely, initial bullish signal could be expected on firm break above bull-trendline (1.1020) and current range top (1.1032), with lift above daily cloud (which twists today and possibly being magnetic) to improve near-term structure.

Break above daily Kijun-sen (1.1082) and 21 Nov high (1.1096) would signal reversal and shift focus higher.

Res: 1.1020; 1.1032; 1.1054; 1.1082

Sup: 1.1000; 1.0989; 1.0949; 1.0940