Fresh weakness signals an end of recovery; weak German ZEW data would add to negative tone

The Euro is holding in red in early Tuesday’s trading as dollar regained traction after aggressive Fed’s action was followed by other main central banks.

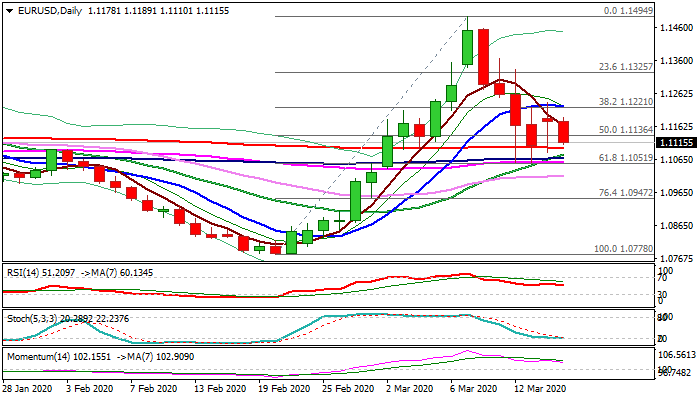

Monday’s long-legged Doji showed indecision, with recovery attempts being rejected at pivotal Fibo barrier at 1.1222 (38.2% of 1.1494/1.1054) and subsequent weakness suggesting that recovery might be over.

Daily indicators are pointing lower and support near-term action, as fresh bears pressure 200DMA (1.1098) which contained several attacks in past few sessions.

Close below 200DMA will be negative signal which will require confirmation on close below 1.1051 (Fibo 61.8% of 1.0778/1.1494) and signal extension of bear-leg from 1.1494 (9 Mar high).

German ZEW data are key event for Euro today, with downbeat forecasts (Mar economic sentiment -26.4 f/c vs 8.7 prev) suggesting disappointing results that would increase pressure on the single currency.

Res: 1.1136; 1.1189; 1.1222; 1.1236

Sup: 1.1098; 1.1080; 1.1066; 1.1051