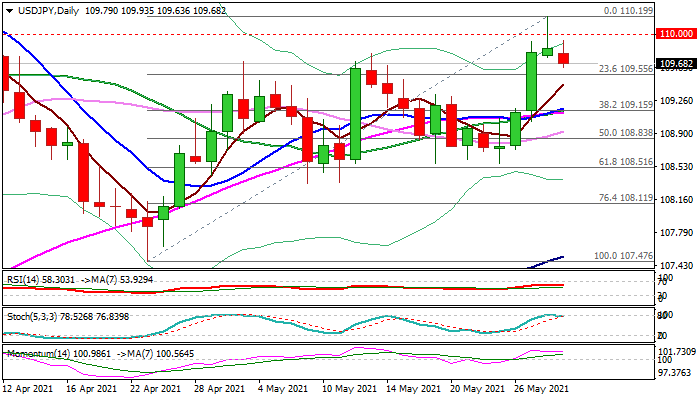

Friday’s bull-trap warns of deeper pullback

The dollar is standing at the back foot in European trading on Monday following Friday’s inverted hammer (bearish signal) which was formed after four-day advance stalled on probe above 110 barrier.

Rising risk of pullback is verified by bull-trap above 110 mark on daily chart and strong weekly gains that prompted profit-taking.

Daily technical studies show stochastic reversing from overbought territory and 14-d momentum turned to sideways mode, supporting the notion

Today’s bearish close would generate initial bearish signal which would look for confirmation on close below double-Fibo support at 109.57/55 (Fibo 38.2% of 108.55/110.19 upleg / 23.6% of 107.47/110.19).

Only bounce and close above 110 would neutralize risk of pullback and bring larger bulls to play.

Res: 109.81; 110.00; 110.19; 110.55

Sup: 109.55; 109.43; 109.15; 108.91