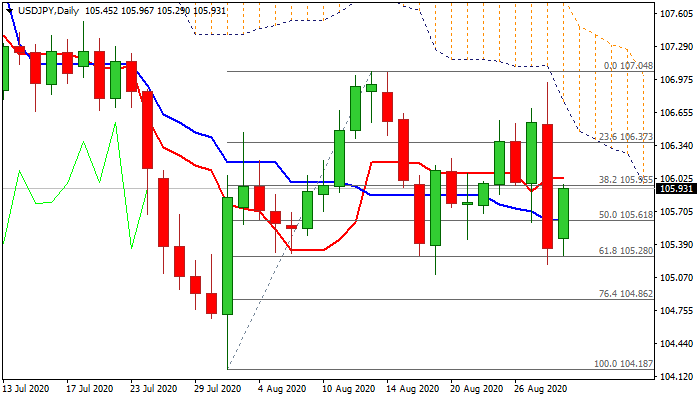

Friday’s massive bearish candle and falling thick daily cloud weigh heavily

The pair bounces from new two-week low, posted after Friday’s 1.1% fall (the biggest one-day loss since 8 June).

Markets digested news of Japan PM Abe’s resignation, with focus turning towards Japan’s unemployment, services PMI and US non-farm payrolls, due later this week.

Today’s bounce was boosted by Friday’s failure to clearly break below key Fibo support at 105.28 (61.8% of 104.18/107.04), but bounce was so capped by a cluster of daily MA’s in 106 zone, which should ideally limit the upside and keep bears intact.

The base of falling and thickening daily cloud (106.48) is expected to cap extended upticks.

Friday’s massive bearish daily candle weighs on near-term action, along with bearish weekly candle with very long upper shadow and thick daily cloud.

Bears need close below 105.28 Fibo support and recent lows at 105.20/10 to signal continuation towards 104.18 (31 July low and 103.94 (200MMA).

Res: 106.04; 106.24; 106.27; 106.48

Sup: 105.61; 105.28; 105.10; 104.86