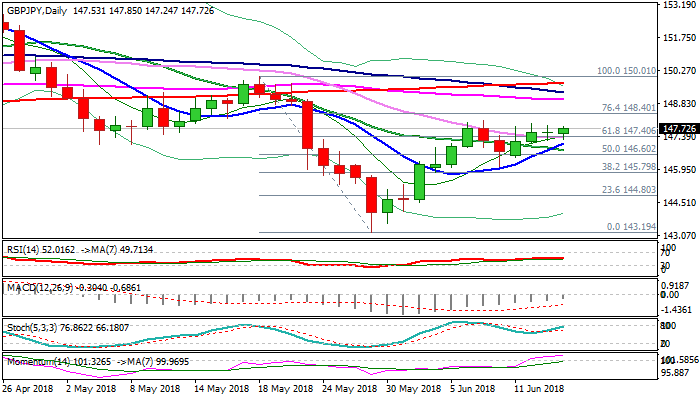

GBPJPY – near-term outlook improves following rally on upbeat UK data, but the price remains within three-day congestion

The cross moved higher around 60 pips as pound got boosted from stronger than expected UK retail sales (May 1.3% vs 0.5% f/c and Apr upward-revised figure at 1.8%).

Fresh strength pressures tops of 147.98/12 congestion which extends into third day and turns near-term focus higher after yesterday’s Doji signaled indecision.

Bullish bias is supported by 10/20SMA / daily Tenkan/Kijun-sen bull crosses and strengthening momentum, as daily cloud which lies above and twists next Tuesday, could attract fresh advance.

Bullish scenario requires close above 148.11 / 27 (07 June high / weekly cloud top) for confirmation and signal of bullish continuation towards the base of thinning daily cloud (149.41).

Conversely, fall below 147.12 (congestion low, reinforced by rising 10SMA) would generate initial negative signal, which requires confirmation on break below daily Kijun-sen (146.60).

Res: 147.98; 148.11; 148.27; 148.40

Sup: 147.25; 147.11; 146.60; 146.23