GBPUSD awaiting fresh news about Brexit; overall picture is bearish

The pair is holding within tight range in early Friday’s trading ahead of much anticipated speech of UK PMI May, in which she will bring her plan about country’s future after Brexit.

Threats of Brexit talks stall on a dispute over the border with Northern Ireland and comments from EU Brexit negotiator Barnier who said that a free trade agreement between the EU and Britain was the only option left, kept the strong pressure on pound.

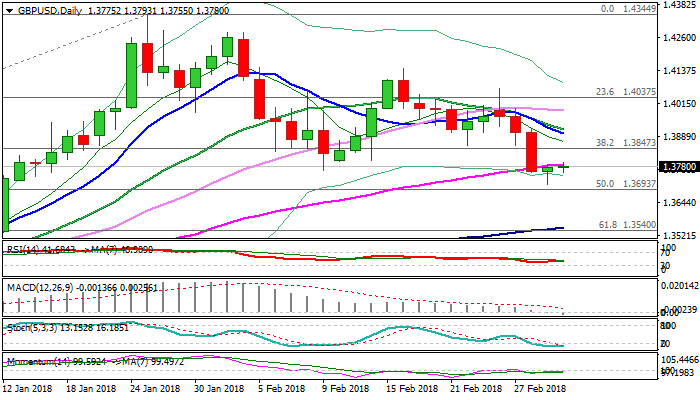

Strong four-day bearish acceleration hit new low at 1.3711 on Thursday, where bears found temporary footstep, taking a breather ahead of fresh news from Brexit negotiations.

Slight recovery off 1.3711 low formed Hammer candle on Thursday, but little positive impact was seen so far, as recovery attempts remain capped by broken ascending 55SMA (1.3787).

Firm break and close above 55SMA is needed to validate reversal signal and open way for further recovery.

However, bearish setup of daily MA’s and momentum holding in negative zone, continue to weigh along with increased Brexit concerns.

Fresh bearish acceleration through initial supports at 1.3703/1.3698 (daily cloud base / Fibo 50% of 1.3042/1.4344 ascend) could extend towards next targets at 1.3550/40 zone (rising 100SMA / Fibo 61.8%).

Bears need firm break below cracked pivot at 1.3764 (09 Feb low) to complete failure swing pattern on daily chart and spark fresh extension of pullback from 1.4344 (2018 high, posted on 25 Jan).

Res: 1.3787; 1.3847; 1.3900; 1.3918

Sup: 1.3755; 1.3700; 1.3674; 1.3618