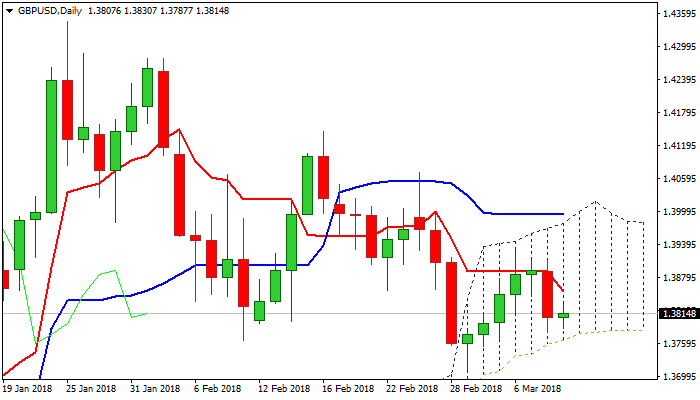

GBPUSD – bearish bias suggests further weakness through daily cloud base; UK/US data eyed for fresh signals

Cable is consolidating on Friday following strong fall on Thursday, which reversed the biggest part of four-day 1.3711/1.3929 rally and turned near-term bias to bearish mode.

Fresh bears are pressuring key near-term support at 1.3765 (daily cloud base).

Thursday’s fall completed reversal pattern on daily chart, which weighs on near-term action.

Daily MA’s are back to bearish setup and maintain pressure, along with negative momentum studies.

Daily cloud base is key and firm break lower would generate fresh bearish signal for retest of 1.3711 pivot and possible extension lower.

Batch of UK data are in immediate focus and miss would increase pressure, with US NFP data eyed for further signals.

Strong numbers from US labor sector would further pressure pound.

Broken 55 SMA (1.3830) is initial resistance and caps the upside for now, with stronger rally above 10SMA (1.3845) needed to sideline immediate bearish risk.

Res: 1.3830; 1.3845; 1.3890; 1.3905

Sup: 1.3780; 1.3765; 1.3711; 1.3660