GBPUSD – BoE speakers and inflation report eyed for fresh signals

Cable retests former key support at 1.3451 on acceleration higher in early Europe, after eventual break and close below two-week range on Monday.

Fresh bears were boosted by fears of snap election in autumn and hit new five-month low at 1.3390 on Monday, but Foreign Minister Johnson ruled out speculations.

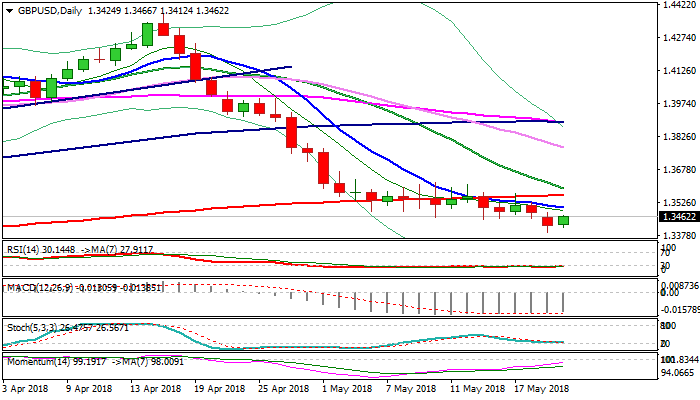

Pound stands at the back foot as close below 1.3451/42 (former range floor / Fibo 38.2% of 1930/1.4376 rally) was strong bearish signal which needs confirmation on repeated daily close below, to signal continuation of steep descend from 1.4376 (post-Brexit recovery peak).

Overall bearish outlook is partially offset by strong momentum and keeping the downside limited.

Speeches of BoE Governor Carney and other three MPC members as well as UK Inflation report are key events for pound today.

Bearish signal would be generated on repeated close below 1.3451/42 pivots, which would open way towards higher base at 1.33 zone (Dec 2017).

Conversely, bears could be delayed on close above 1.3451, but close above 10SMA (1.3503) is needed to confirm and expose next strong barrier at 1.3560 (200SMA).

Res: 1.3482; 1.3503; 1.3560; 1.3589

Sup: 1.3412; 1.3390; 1.3354; 1.3302