GBPUSD – bulls regained control and look for renewed attack at key barriers

Cable returned to strength after limited impact from upbeat US PMI’s (Thursday) and disappointing UK retail sales (Friday), establishing above 1.2700 mark in US trading on Friday.

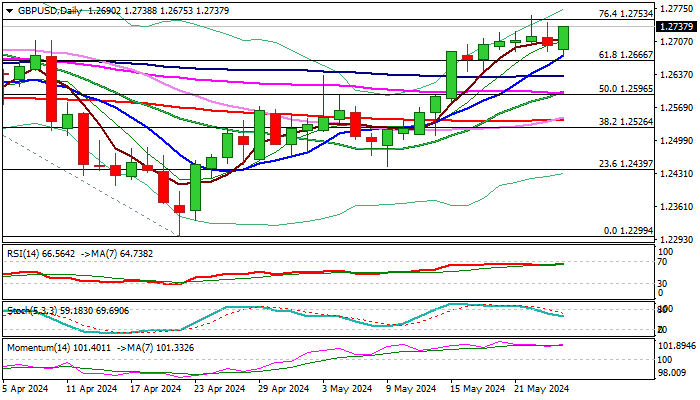

The pair is on track for the second weekly gain and potential bullish engulfing pattern formation on daily chart, which would add to positive near term outlook.

However, fresh bulls need more efforts to neutralize negative signals from long upper shadows on Thu/Wed daily candlesticks and bull-trap above 1.2753 Fibo barrier (76.4% retracement of 1.2893/1.2299 descend), which require weekly close above 1.2753.

Multiple daily MA bull-crosses and strong positive momentum support the notion, though repeated failure to clear 1.2753 pivot would keep the pair in extended range between two Fibo levels.

Near-term bias to remain with bulls as long as the price holds above 10DMA / broken Fibo 61.8% (1.2677/66), while break lower would weaken near-term structure and risk deeper pullback.

Res: 1.2753; 1.2761; 1.2803; 1.2823

Sup: 1.2677; 1.2666; 1.2633; 1.2598