GBPUSD cracks 1.3500 barrier and hits a multi-month high on upbeat UK economic data

Cable rose 0.5% on Friday morning and cracked psychological 1.3500, hitting the highest since February 2022.

Fresh acceleration higher was sparked by upbeat UK retail sales, which strongly beat forecasts in April and boosted risk sentiment.

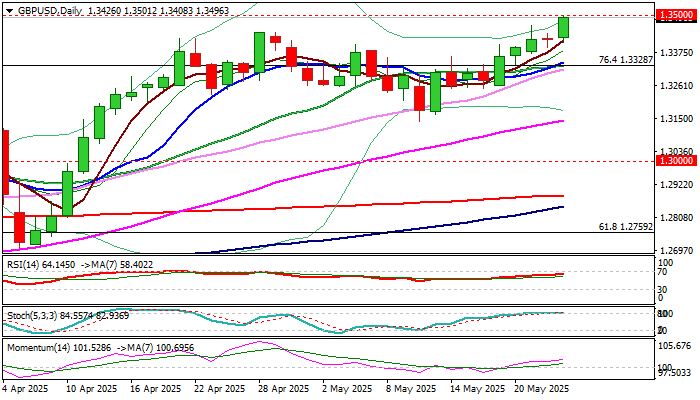

Bullish continuation pattern is developing on weekly chart as cable broke through key resistances at 1.3434/44 (2024/2025 tops), with weekly close above these levels to validate the signal.

This week’s action was shaped in a large bullish candle which is on track to offset initial reversal signals from weekly Hammers and Doji candles in past four weeks.

Also, the pair is on track to complete the fourth consecutive month of strong gains that adds to bullish outlook, along with a kind of bear-trap that formed below 1.3200 psychological support on monthly chart.

Recent solid UK economic data, hotter than expected inflation and weakening dollar are likely to continue to underpin the pound.

Sustained break of 1.3434/44 pivots to signal continuation of larger uptrend and expose targets at 1.3643/1.3748 (Jan / Feb 2022 tops) and unmask psychological 1.40 barrier.

Meanwhile, overbought conditions may pause rally for consolidation / limited correction, which would mark positioning for further advance.

Former breakpoints (1.3434/44) reverted to initial but solid supports, with 4-hr chart higher base at 1.3390 zone to contain dips and keep bulls intact.

Res: 1.3500; 1.3557; 1.3600; 1.3643

Sup: 1.3484; 1.3444; 1.3434; 1.3390