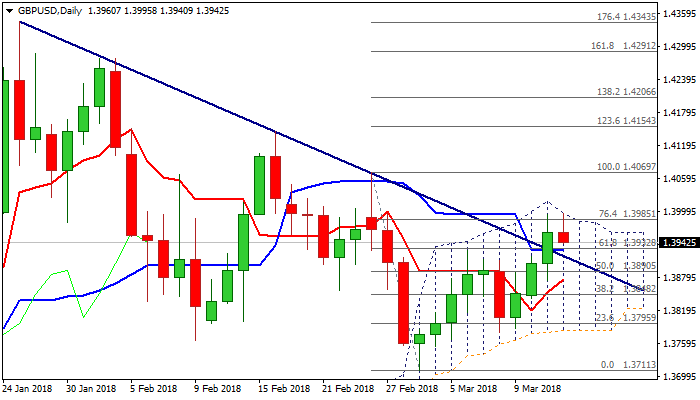

GBPUSD – daily cloud top marks significant barrier

Cable maintains positive tone after Tuesday’s rally and close above 1.3930 pivot (bear-trendline / Fibo 61.8% of 1.4067/1.3711) but bulls were so far capped just under psychological 1.40 barrier, where daily cloud top marks strong barrier.

Mixed signals from daily studies add to near-term outlook as MA’s in bullish configuration is conflicted by weakening momentum and overbought slow stochastic.

Repeated upside failure would be signal for fresh shorts, which would require further negative signals on return and close below bear-trendline (currently at 1.3928) and violation of next pivot at 1.3886 (Fibo 38.2% of 1.3711/1.3995 rally).

Bullish bias is expected to remain in play while broken trendline holds, but close above daily cloud is needed to confirm continuation and expose next key barrier at 1.4069 (26 Feb high).

Res: 1.4000; 1.4069; 1.4100; 1.4144

Sup: 1.3932; 1.3912; 1.3886; 1.3866