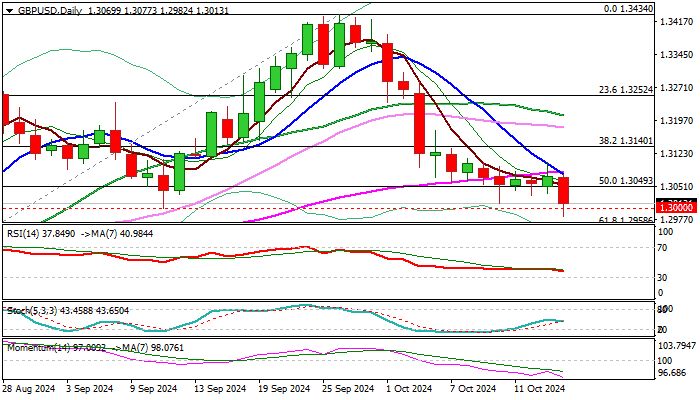

GBPUSD dips below 1.30 on weaker than expected UK CPI numbers

Cable accelerated lower and cracked psychological 1.30 support, to hit the lowest in almost two months in early Wednesday.

Sterling was down 0.8% in immediate reaction to economic data which showed that UK inflation fell more than expected in September and dipped below BoE’s 2% target, adding to bets for more rate cuts towards the end of the year.

Fresh weakness generates an initial signal of continuation of a downtrend from 1.3434 (2024 high of Sep 26), with close below 1.30 required to validate the signal.

Sustained break of 1.30 trigger to expose targets at 1.2958/52 (Fibo 61.8% of 1.2664/1.3434 / 100DMA) and more significant daily cloud base (1.2941) and 200DMA (1.2792).

Technical picture is bearishly aligned with strong negative momentum and the latest formation of 10/55DMA’s weighing on near-term action, however, bears would face a difficult task to clearly break 1.30 level (the last attack on Sep 11 was strongly rejected).

Potential upticks should be ideally capped by cloud top (1.3054) and not to exceed falling 10DMA (1.3076) to keep bears intact.

Res: 1.3049; 1.3071; 1.3113; 1.3140

Sup: 1.3000; 1.2982; 1.2952; 1.2941