GBPUSD – downside pressure rises after recovery stall and a bull-trap

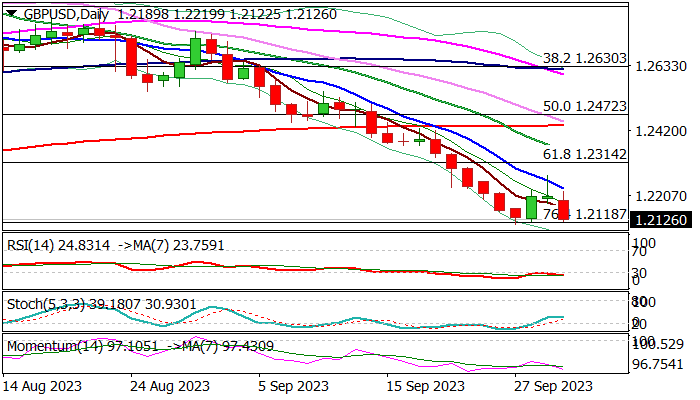

Cable lost ground on Monday and retraced the most of bounce from new multi-month low (1.2110) in past two days.

Friday’s candle with long upper shadow signaled that recovery was strongly rejected and formation of a bull-trap above falling 10DMA, added to signs of stall.

Fresh bears pressure again cracked Fibo support at 1.2118 (76.4% of 1.1802/1.3141 rally) but may face headwinds here again, as daily RSI remains in oversold territory.

Prolonged consolidation could be expected on repeated failure to break lower, though, bearish bias to remain as long as falling 10DMA (1.2231) caps.

Break of 1.2118 pivot would open way for test of key supports at 1.2074/1.2000/1.1988 (Fibo 38.2% of 1.0348/1.3141 / psychological / top of rising and thickening weekly Ichimoku cloud) loss of which would signal deeper fall.

Sterling is expected remain under increased pressure after September’s 3.7% drop (the biggest monthly loss since Aug 2022), as markets remain optimistic about the US economy, which is likely to have soft landing, due to limited negative impact from high borrowing cost.

US manufacturing PMI surprised to the upside in September, coming closer to 50 threshold, while focus shifts on several reports from the US labor sector, due this week.

Res: 1.2164; 1.2229; 1.2271; 1.2314

Sup: 1.2110; 1.2074; 1.2000; 1.1988