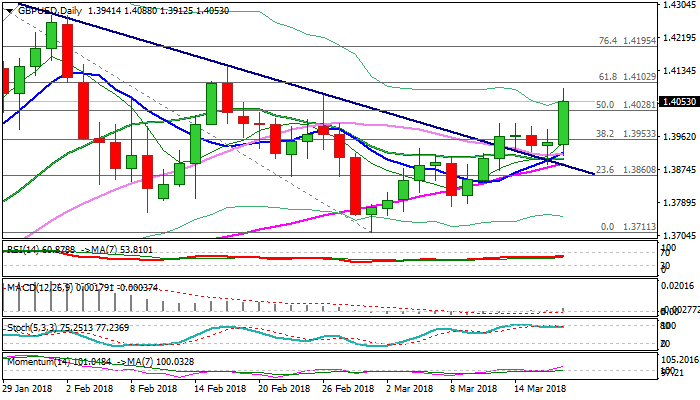

GBPUSD – eventual break above 1.40 pivot

Cable eventually broke above 1.40 barrier on Monday after being congested under it for past four days. Fresh bullish acceleration on Monday was sparked by comments about UK and EU reached Brexit deal, and sent pound to new one-month high against the dollar at 1.4088.

Break above daily cloud was strong bullish signal for continuation of recovery leg from 1.3711 (01 Mar low) which broke through initial targets at 1.4028/70 and eyes pivotal barrier at 1.4102 (Fibo 61.8% of 1.4345/1.3711 descend).

Bullish daily techs underpin the advance with multiple bull-crosses (10/20; 10/30SMA & Tenkan/Kijun-sen) and fresh bullish momentum building on daily chart.

Close above daily cloud will be bullish signal, but bulls may show hesitation 1.4102 Fibo barrier, as slow stochastic reversed from overbought territory and formed bearish divergence on daily chart.

Strong bullish sentiment suggests limited downside before bulls continue, however, focus turns on Tuesday’s UK inflation data, which could affect bulls if CPI falls below expectations (Feb f/c 2.8% vs 3.0% in Jan).

Broken daily cloud top is expected to contain extended dips and keep fresh bulls in play, while return and close below would be negative signal.

Res: 1.4088; 1.5102; 1.4144; 1.4195

Sup: 1.4028; 1.3995; 1.3961; 1.3928