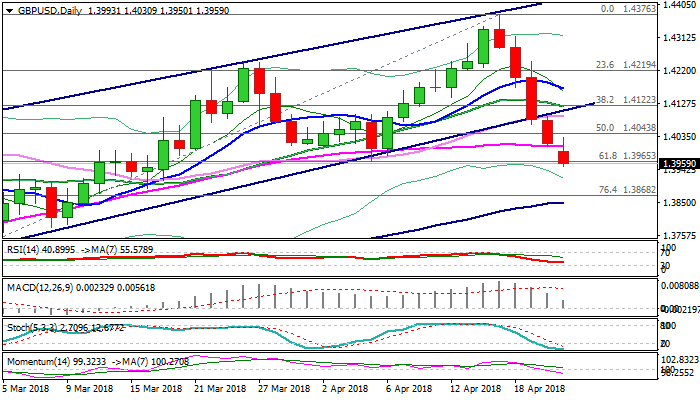

GBPUSD – extension through 1.40/1.3965 supports is strong bearish signal

Cable remains in steep descend which extended into fifth straight day and broke below key supports at 1.4000/1.3965 (psychological support / Fibo 61.8% of 1.3711/1.4376 / 05 Apr trough) on fresh bearish acceleration on Monday.

Sterling maintains strong bearish sentiment on fading hopes about BoE rate hike next month, following downbeat key UK data (wages; CPI; retail sales) and dovish comments from BoE’s chief Carney last week.

Bears pressure next supports at 1.3931/01 (thin daily cloud) which is seen as not strong obstacle.

Close below 1.3965 would generate bearish signal for extension through daily cloud towards 1.3868 (Fibo 76.4% of 1.3711/1.4376 ascend) and 1.3850 (rising 100SMA).

Slow stochastic is in deeply oversold territory on daily chart but continues to trend lower, suggesting bears remain uninterrupted for now, but may take a breather soon.

Broken 1.40 support is reinforced by 55SMA and marks initial barrier, guarding 1.41 zone (broken bull-channel support line / broken 30SMA).

Res: 1.4008; 1.4030; 1.4094; 1.4103

Sup: 1.3931; 1.3901; 1.3868; 1.3850