GBPUSD eyes UK data for fresh direction signals

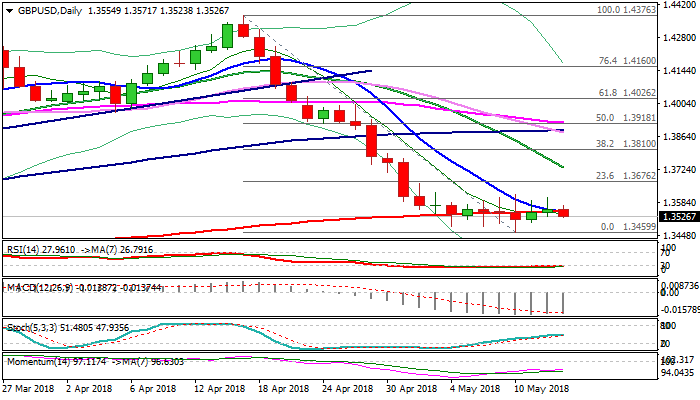

Cable remains within extended range after upside attempts on Monday stalled on approach to range top (1.3617), staying in directionless mode for the second week.

Signals from technical studies are still mixed as momentum continues to strengthen, slow stochastic heads north, but 10/200SMA death-cross is forming and generating negative signal.

UK data today are the key event for sterling and earnings are in focus for fresh signals.

Headline earnings are forecasted at 2.7% in Mar vs 2.8% previous month, while ex-bonus earnings are expected to rise to 2.9% from 2.8% previous month.

On the other side, UK jobless claims are expected to increase in Apr (13.3K f/c vs 11.6K previous month), while unemployment is expected to stay unchanged at 4.2%.

Stronger than expected earnings could boost pound as upbeat figures could boost expectations for BoE rate hike in August.

Bullish acceleration needs clear break above range top to generate initial signal and open way for recovery extension towards 1.3733 (falling 20SMA).

Conversely, earnings miss would weaken the structure and risk break below range floor (1.3460) for test of next pivotal support at 1.3442 (Fibo 38.2% of 1.1930/1.4376 post-Brexit recovery).

Res: 1.3571; 1.3617; 1.3676; 1.3733

Sup: 1.3500; 1.3484; 1.3460; 1.3442