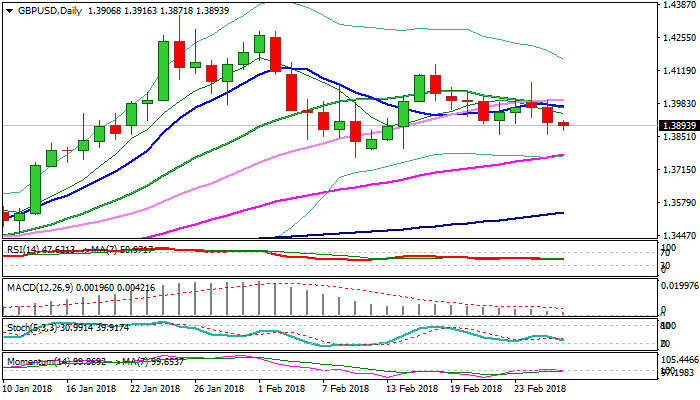

GBPUSD – fresh bears pressure higher base at 1.3856; near-term outlook is negative

Cable maintains bearish bias on Wednesday, holding in red for the third consecutive day and pressures higher base at 1.3856 (lows of 22/27 Feb).

Fresh strength of the greenback after Powell keeps pound under pressure, with Tuesday’s eventual close below 1.3909 (Fibo 61.8% of 1.3764/1.4144 upleg) after several failures, generating bearish signal.

Support at 1.3856 is reinforced by the top of rising daily cloud (1.3841) and sustained break here will be another strong signal for further weakness towards key short-term support at 1.3764 (09 Feb trough / rising 55SMA).

Daily MA’s (10/20/30) are in full bearish setup and formed multiple bear crosses, while 14-d momentum is entering negative territory and maintaining bearish pressure for triggering stronger negative scenario on break below the lower boundary of 1.3764/1.4144 range.

Meanwhile, corrective upticks will be seen as selling opportunities and are expected to hold below psychological 1.40 barrier, reinforced by daily Tenkan-sen.

Res: 1.3916; 1.3966; 1.4000; 1.4054

Sup: 1.3856; 1.3841; 1.3800; 1.3764