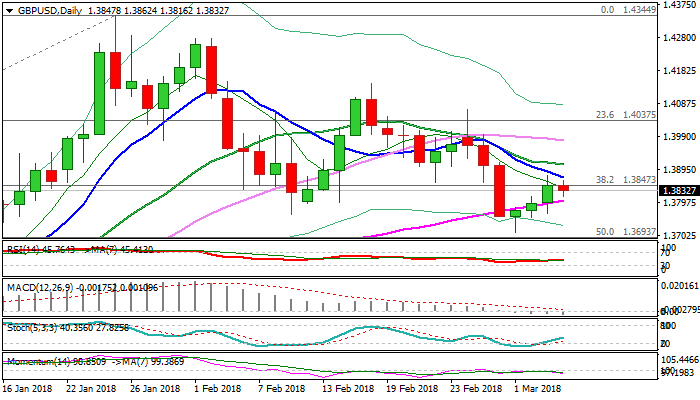

GBPUSD holds in narrowing range between 55 and 10SMA, but negatively aligned techs keep the downside vulnerable

Cable showed little action in Asia / early Europe on Tuesday but holding in red for now after upside attempts stalled on approach to descending 10SMA (1.3871).

The pair is trading in the middle of thick daily cloud, with today’s action holding within narrowing range, defined by falling 10 SMA and ascending 55SMA (1.3804).

Initial signs of stall of recovery leg from 1.3711 (01 Mar trough) are developing but need reversal and close below 55SMA for stronger negative signal.

Bearish momentum studies on daily chart support negative scenario, along with falling 10/20/30 SMA’s in firm bearish setup.

At the upside, falling 10SMA marks initial barrier, break of which would look for confirmation of bullish signal on lift above 20SMA (1.3908) to expose pivotal barrier at 1.3944 (daily cloud top).

With no releases from the UK scheduled for today, the pair is expected to be driven by techs and news.

Res: 1.3871; 1.3908; 1.3944; 1.3979

Sup: 1.3862; 1.3804; 1.3766; 1.3740