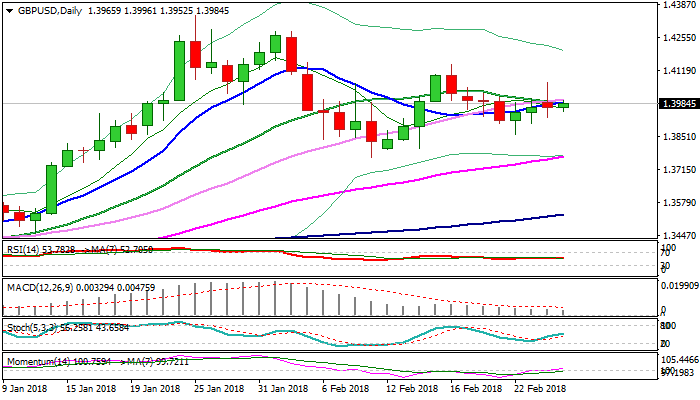

GBPUSD holds in tight range under 1.40 barrier

Cable holds within tight range on Tuesday, capped at 1.40 barrier, following strong upside rejection at 1.4067 yesterday and close below 1.40, which left bearish daily candle with long upper shadow that weighs on today’s action.

Daily MA’s are in neutral setup but momentum studies are positive, keep in play hopes for fresh attempts through 1.40 pivot (psychological barrier / 50% of 1.4144/1.3856 / daily Tenkan-sen) which repeatedly capped upside attempts in past few sessions.

Firm break here would generate bullish signal for further retracement of 1.4144/1.3856 downleg, while repeated failure would keep the downside vulnerable. Return below Monday’s low at 1.3928 would soften near-term structure and risk return to 1.3856 (low of 22 Feb).

With no events from the UK scheduled today, focus will turn towards a number of data from the US and the speech of Fed Chairman Powell.

Res: 1.4000; 1.4034; 1.4067; 1.4100

Sup: 1.3952; 1.3928; 1.3904; 1.3856