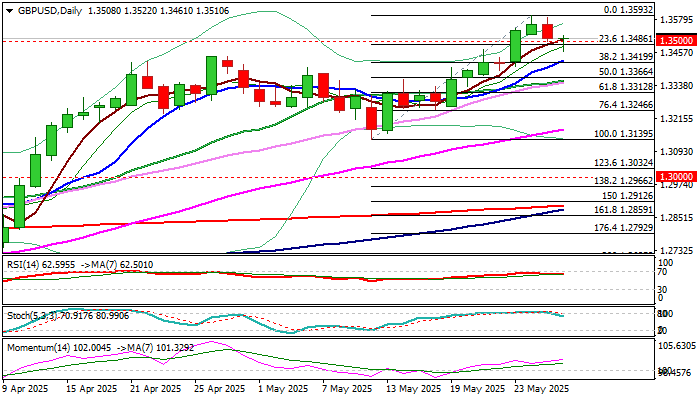

GBPUSD – initial supports hold pullback for now

Cable remains at the back foot on Wednesday after Tuesday’s pullback from new multi-month high (1.3593) cracked psychological 1.3500 support.

Price dipped to 1.3561 this morning, but quick bounce to 1.3500 zone points to headwinds that fresh bears face.

Today’s action was so far shaped in Doji candle (indecision) with short-lived probe below initial Fibo support at 1.3486 (23.6% of 1.3195/1.3593 upleg) adding to potential bear-trap formation, in scenario of very shallow pullback preceding fresh attempts to extend larger uptrend.

Daily studies remain in full bullish configuration and support the notion.

Alternatively, loss of 1.3486/61 triggers would keep the downside vulnerable and risk attack at pivotal 1.3420 support (10DMA / Fibo 38.2%).

Res: 1.3544; 1.3564; 1.3593; 1.3643

Sup: 1.3486; 1.3461; 1.3420; 1.3400