GBPUSD keeps firm tone ahead of Powell’s testimony

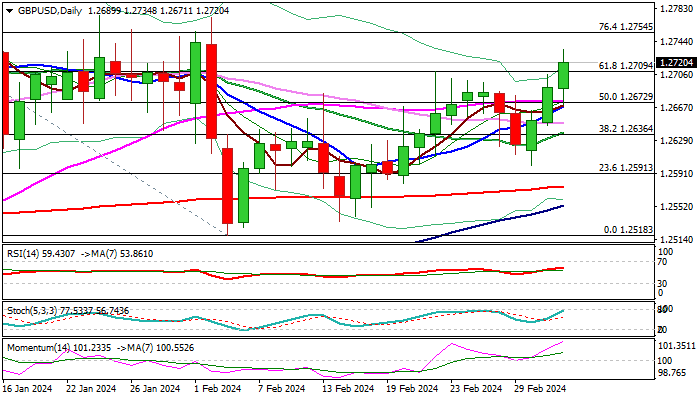

Cable extends the bull-leg from 1.2599 higher low into third straight day and broke above significant barriers at 1.2700 zone (Fibo 61.8% of 1.2827/1.2518 / daily cloud top).

Positive near-term sentiment received fresh boost from weaker than expected US Feb non-manufacturing PMI which pushed the dollar lower, while markets await more information about the US rate outlook from Fed Chair Powell’s two-day testimony (Wed/Thu).

Bulls may accelerate further and risk retesting key barriers at 1.2785 (2024 high) and 1.2827 (Dec 28 peak) in dovish shift from Powell, as bets for the first rate cut in June grow, following warnings from the recent weaker than expected US economic data.

Markets will also closely watch releases of series of labor data from the US (ADP, JOLTS, NFP) which will provide more details about the US labor sector condition.

Res: 1.2734; 1.2772; 1.2785; 1.2827

Sup: 1.2700; 1.2672; 1.2650; 1.2636