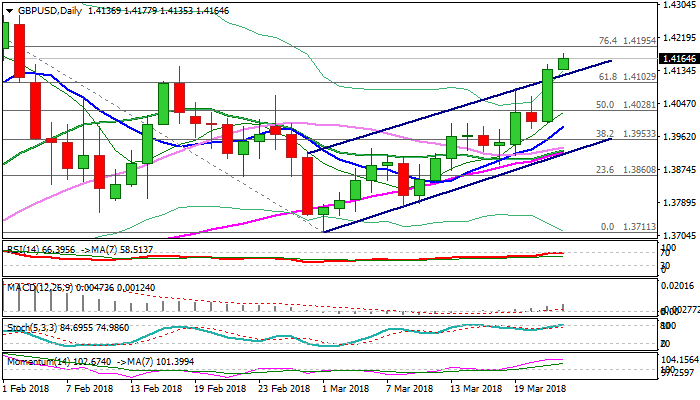

GBPUSD – post-Fed acceleration broke above bull-channel; BoE MPC decision eyed for fresh signals

Sterling continues to advance, supported by positive news about Brexit negotiations and additionally boosted by less hawkish than expected Fed, which sent the greenback lower.

Wednesday’s rally generated bullish signal on close above important barriers at 1.4102 (Fibo 61.8% of 1.1345/1.3711 descend) and bull-trendline at 1.4122 (the upper boundary of bull-channel from 1.3711.

Positive sentiment is additionally supported by bullish daily techs, keeping strong bullish bias.

Extension above 1.42 barrier (near Fibo 76.4%) would open way towards double top at 1.4277 (01/02 Mar) and bring in focus key short-term barrier at 1.4345 (the highest traded since Brexit vote in June 2016).

Two key events for sterling are in focus today. UK retail sales are forecasted higher in Feb, with BoE MPC rate decision and minutes following.

The UK central bank is expected to keep rates unchanged at 0.50% on today’s meeting but voting results will be closely watched and hawkish outcome would further boost expectations for May rate hike and send pound higher.

Res: 1.4177; 1.4195; 1.4277; 1.4300

Sup: 1.4134; 1.4102; 1.4070; 1.4028