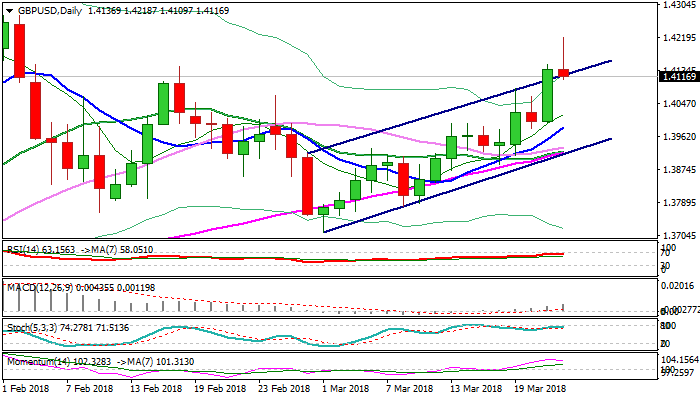

GBPUSD – quick pullback from post-BoE spike high could form negative signal on daily chart

Sterling spiked to 1.4218, the highest since 02 Feb, after BoE kept interest rates unchanged on Thursday, but surprised markets by 7-2 voting results 9-0 expected, as two MPC members voted for rate hike.

New situation within policy makers improves the outlook, increasing hopes for central bank’s action as early as May.

Cable spiked in immediate reaction on BoE’s decision, but reversed gains on quick pullback which resulted in posting new daily low at 1.4112.

Strong upside rejection could be initial negative signal and could result in bearish daily candle with long upper shadow, which could increase risk of deeper pullback.

Another negative signal is forming on slow stochastic, where bearish divergence warns of further easing.

Profit-taking after strong gains in past couple of sessions could accelerate pullback, which currently probes below broken upper boundary of bull-channel and pressures supports at 1.4102/1.4092 (broken Fibo 61.8% of 1.4345/1.3711 descend / Fibo 38.2% of 1.3889/1.4218 upleg) .

Close below the latter would generate further negative signal for deeper correction and risk retest of psychological 1.40 support (former strong barrier).

Res: 1.4150; 1.4218; 1.4277; 1.4300

Sup: 1.4102; 1.4092; 1.4070; 1.4053