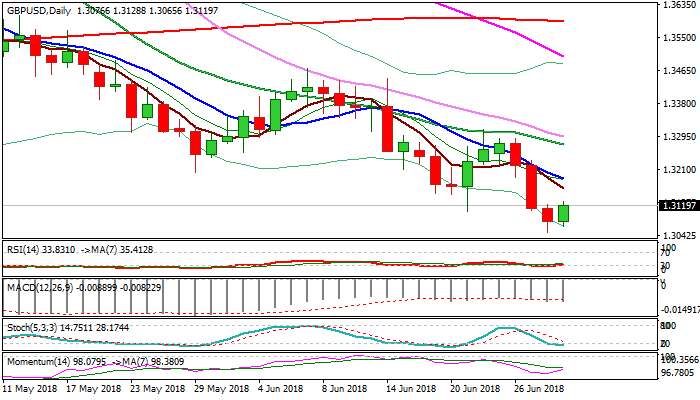

GBPUSD – recovery attempts need break above falling 10SMA for bullish signal

Cable was up in early trading on Friday, dragged by Euro’s advance on migration deal, but recovery was so far limited by falling thick hourly cloud which continues to weigh.

Initial bullish signals were generated on daily RSI reversal from oversold territory and formation of bullish divergence, along with 14-d momentum turning north, but more upside action is required to confirm reversal.

Falling 10SMA marks pivotal barrier at 1.3188, break of which is needed to provide relief and sideline immediate bears for further recovery.

Overall picture remains firmly bearish and sees current action as positioning for final attack at 1.3038/30 targets (03 Nov 2017 low / psychological support), with extended upticks on end-of-week profit-taking, expected to stall under falling 20SMA (1.3274).

UK GDP and CA data are key events for sterling today.

Res: 1.3161; 1.3188; 1.3213; 1.3239

Sup: 1.3101; 1.3065; 1.3049; 1.3038