GBPUSD – recovery shows signs of stall ahead of BoE rate decision

Cable dipped during early European trading on Wednesday, deflated by weak UK data (July Construction PMI fell to the lowest since 2020), although the price holds within the range that extends into third consecutive day (long-legged Doji candles point to strong near-term indecision).

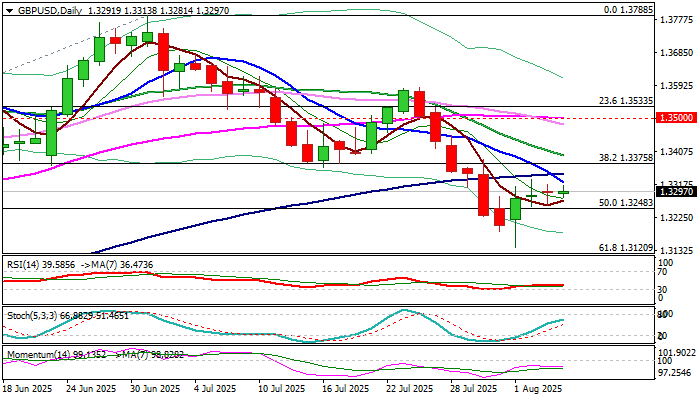

Overall technical picture remains negative (daily MA’s are in bearish setup with the latest formation of 10/100 and 30/55DMA bear-crosses / 14-d momentum remains in negative territory) and supports scenario of recovery stall before larger bears regain full control.

Recent range top (1.3330, reinforced by falling 10DMA) should keep the upside protected and guard barriers at 1.3348 (100DMA) and 1.3375 (broken Fibo 38.2% of 1.2708/1.3788.

Violation of temporary support at 1.3248 (cracked Fibo 50%) to expose targets at 1.3141 (Aug 1 three-month low) and 1.3120 (Fibo 61.8%).

Markets await BoE’s rate decision (due on Thursday), with the central bank expected to cut rates to 4.00% from 4.25% that would add more pressure on sterling.

Res: 1.3330; 1.3348; 1.3375; 1.3397

Sup: 1.3248; 1.3185; 1.3141; 1.3120