GBPUSD regains traction after strong downside rejection; upbeat retail sales to spark further recovery

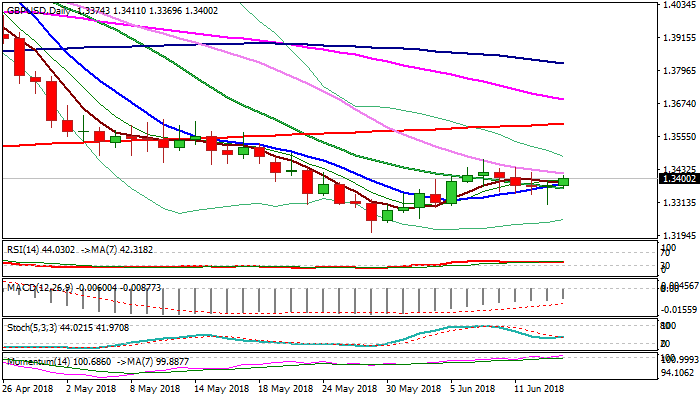

Cable regained traction and rose above 1.34 handle on Thursday, signaling further recovery after pullback from 1.3472 faced strong rejection at 1.3307 on Wednesday as near-term bears off 1.3472 showed strong indecision on double-long-legged Dojis on Tue/Wed.

Momentum remains strong and underpins recovery which moved above 20SMA (currently at 1.3365) after downside attempts repeatedly failed to close below it.

Overall setup on daily chart is bullish and supportive for further recovery.

UK retail sales could be a trigger if May’s figure beats forecast at 0.5%.

Extension through 30SMA (1.3420) would expose Monday’s high (1.3441) and could challenge key barrier at 1.3472 (07 June high) in bullish scenario.

Conversely, return below 20SMA would be initial negative signal which requires daily close below to risk further weakness.

Res: 1.3420; 1.3441; 1.3472; 1.3500

Sup: 1.3366; 1.3342; 1.3307; 1.3267