GBPUSD remains constructive ahead of US data

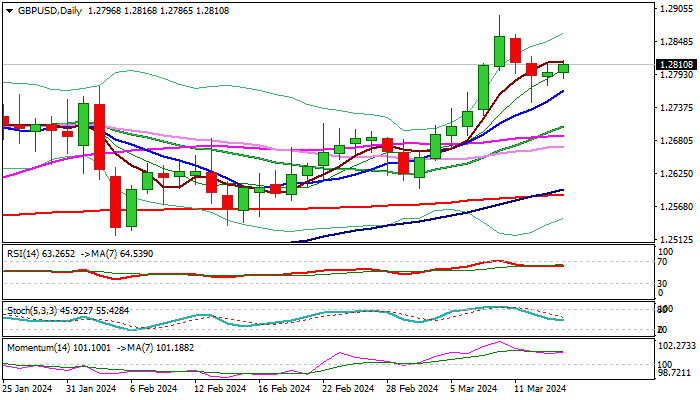

Cable is probing above 1.2800 mark in early Thursday, adding to initial signals that shallow correction from new 8-month high (1.2893) might be over.

Two-day pullback was contained by rising 10DMA, with strong downside rejection on Wednesday, pointing to solid bids and signaling that larger bulls remain firmly in play.

Technical picture on daily chart is bullish (positive momentum is strong and Tenkan / Kijun-sen in bullish setup and diverging), with fresh recovery seeing a daily close above 1.2800 (Fibo 38.2% of 1.2893/1.2745 correction) as minimum requirement to keep near-term action biased higher.

Sterling regained traction after markets digested US inflation data and kept growing expectations for June rate cut, which put the dollar under pressure again.

Markets await release of a batch of US economic data today (retail sales, weekly jobless claims, producer price index) for fresh signals.

Res: 1.2820; 1.2837; 1.2858; 1.2893

Sup: 1.2780; 1.2765; 1.2745; 1.2714