GBPUSD stands at the back foot, weighed by latest Brexit comments

Cable fell to the session low at 1.3245 in early European trading on Monday, following tight range in Asia.

The action at the beginning of the week was capped by 1.33 barrier, weighed by latest comments from British former Foreign Minister Johnson, who expressed his caution regarding the third vote on Brexit plan and suggested that there is enough time to work on real changes on PM May’s plan.

Sterling stands at the back foot, despite weaker dollar on soft US data on Friday, which raised concerns about dovish stance from Fed on Wednesday, with Brexit story being the key driver.

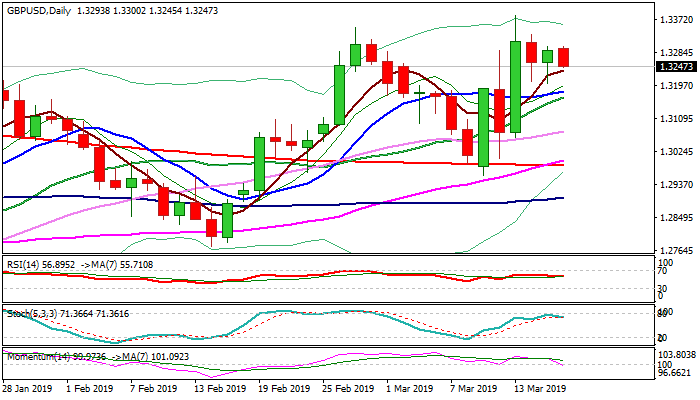

Daily techs are losing momentum and point lower, which increases risk of retesting last Thu/Fri spike lows at 1.3207/02 (strong downside rejections) and extension towards pivotal supports at 1.3181/65 (converging 10/20SMA’s) violation of which would signal deeper pullback from new 2019 high at 1.3381.

Ability to hold above 1.32 handle would keep the price in extended consolidation, with bullish bias and the upside in focus.

This scenario is supported by strong bullish signals, generated on weekly chart on close within weekly cloud and weekly bullish engulfing candle

Res: 1.3300; 1.3330; 1.3349; 1.3381

Sup: 1.3245; 1.3202; 1.3181; 1.3165