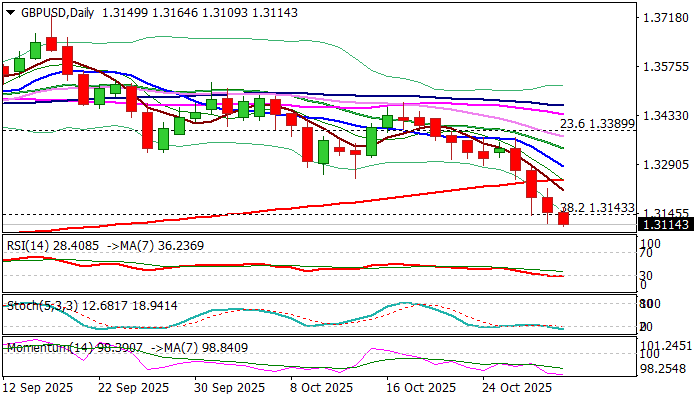

GBPUSD – steep decline extends through key support zone

Cable extends steep fall into fourth straight day and probes through key supports at 1.3140 zone (Fibo 38.2% of 1.2099/1.3788 rally / former higher base, consisting of May 11 and July 27 lows), hitting the lowest levels since mid-April.

Stronger dollar after Fed’s hawkish cut and fresh signals that BOE rate cut next week cannot be ruled out (against wide expectations to stay on hold), keep sterling under increased pressure.

Daily MA’s turned to full bearish setup (latest formation of 5/200DMA death cross adds to negative signals), while bearish momentum remains strong, adding to negative fundamentals and weak near-term outlook.

The pair is on track for the second consecutive weekly loss (bears also accelerated this week) and about to end month in red (monthly loss of 2.4%) contributing to signals of reversal pattern developing on weekly and monthly chart (firm break of 1.3140 supports to complete bearish failure swing pattern).

Bears eye immediate targets at 1.3100 (round-figure) and 1.3078 (55WMA) the last significant obstacles en-route towards psychological 1.30 support.

Meanwhile, price adjustments on oversold studies should be anticipated.

Broken 200DMA (1.3246) reverted to solid resistance which should ideally cap upticks.

Res: 1.3140; 1.3213; 1.3246; 1.3282

Sup: 1.3100; 1.3078; 1.3000; 1.2944