GBPUSD – thick hourly cloud weighs on recovery attempts

Cable fell back below 1.36 handle on downbeat UK services PMI data (Apr 52.8 vs 53.5 f/c), signaling that today’s recovery attempts may be over.

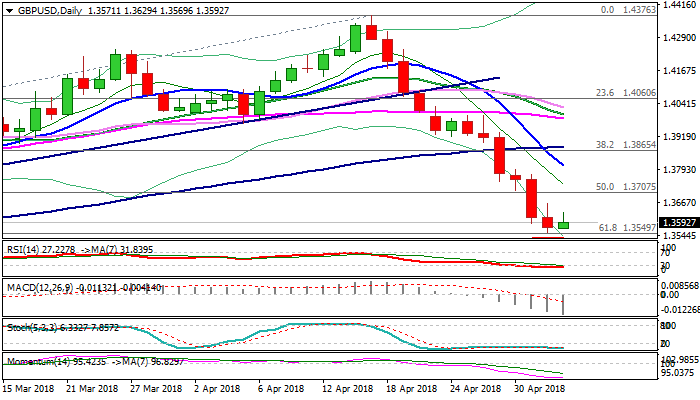

Steep descend from 1.4376 (16 Apr peak) found footstep at 1.3550 (Fibo 61.8% of 1.3038/1.4376 ascend, reinforced by rising 200SMA at 1.3533), above which strong bears may take a breather on oversold daily studies and profit-taking.

However, techs so far show no firmer signals of bounce and today’s recovery stalled at 1.3630, with near-term action weighed by weak UK data and thick hourly cloud (1.3643/86).

Upside prospect remains limited for now and requires lift above hourly cloud and regain of previous key support at 1.3711, to generate bullish signal.

Strong bearish signal could be expected on break below 1.3550/33 pivots which would expose targets at 1.3500 (psychological) and 1.3442 (Fibo 38.2% of 1.1930/1.4376 post-Brexit recovery).

Res: 1.3630; 1.3650; 1.3643; 1.3686

Sup: 1.3550; 1.3533; 1.3500; 1.3442