GBPUSD – weaker than expected UK Q$ GDP could further boost bears

Cable continues to trend lower and hit new low at 1.3869 in early European trading on Thursday (the lowest since 16 Feb), pressured by stronger dollar.

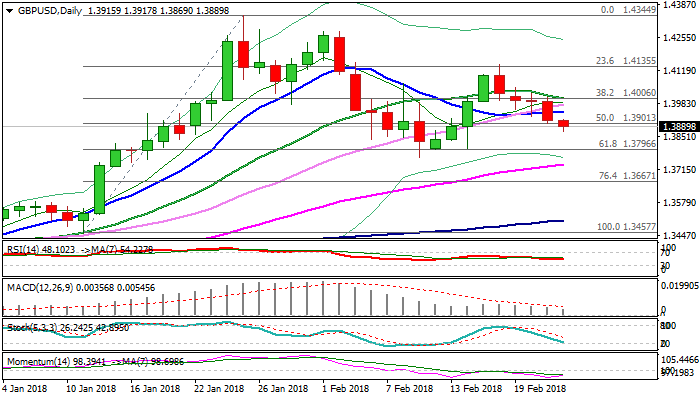

Bearish setup on daily techs adds to negative near-term outlook which could drive pound further down for test of next significant support at 1.3800 zone (Fibo 61.8% of 1.3457/1.4344 upleg).

Further negative impact on sterling could be expected from UK GDP data which showed that Britain’s economy grew at slower pace in the last quarter of 2017 than initially estimated.

UK GDP q/q rose by 0.4% in Q4, missing forecast at 0.5%, which was the figure of Q3.

Annualized GDP also slowed, showing growth by 1.4% in Q3 vs forecasted / Q3 release at 1.5%.

Weaker than expected GDP data could affect strong expectations for BoE’s attempts in normalizing monetary policy.

Cable stays in red for the fifth straight day and bears eye 1.3854 (Fibo 76.4% of 1.3764/1.4144 upleg) break which would open way towards 1.3800 and 1.3764 (09 Feb low).

Broken 10SMA marks solid resistance at 1.3946 which should ideally keep the upside protected and guard next pivot at 1.4000 (psychological barrier / 20SMA).

Res: 1.3917; 1.3946; 1.4000; 1.4049

Sup: 1.3869; 1.3854; 1.3800; 1.3764