Gold advanced 6% in three days, proving its strong safe-haven appeal

Spot gold advanced to new highest level since November 2012 on Tuesday, gaining 1.7% since opening that adds to 4.2% rally in past two days.

Strong concerns over expected slowdown of global economic growth on pandemic lockdown and stimulus measures from central banks and governments in attempt to cushion negative impact, boosted yellow metal’s safe-haven appeal.

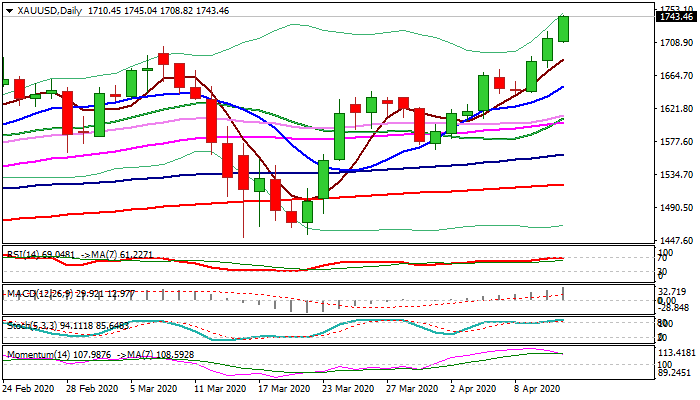

Today’s fresh bullish extension is on track for clear close above important Fibo barrier at $1714 (76.4% of $1920/$1046), following Monday’s marginal close above, would generate bullish signal for extension towards psychological $1800 barrier ($1795 is 2012 high).

Bullish daily studies support the advance, with price action so far ignoring overbought conditions (stochastic) and evident loss of bullish momentum, which give initial signal that bulls would enter consolidation in coming sessions.

Dip-buying remains favored while dips hold above broken strong barriers at $1700 zone, now reverted to supports.

Res: 1750; 1762; 1795; 1800

Sup: 1721; 1712; 1703; 1686