Gold continues to trend higher on rising geopolitical tensions; psychological $2000 barrier coming in focus

Gold extends steep rally and hit three-month high in early Friday, strongly supported by growing demand for safe haven on overheated situation in the Middle East, which threatens to escalate into possible broader regional crisis with unforeseeable consequences.

The yellow metal was up 4.5% last week and is on track for another strong advance this week (around 2.7% so far), with $50 increase seen in past two days.

Adding to support from geopolitics were the latest comments from Fed Chair Powell, who said that financial conditions were tightened by rise in bond yields which might be sufficient to keep the Fed on hold in its November policy meeting.

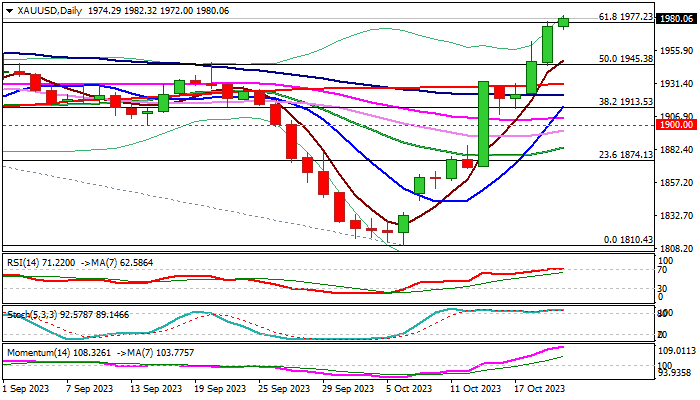

Fresh acceleration on Friday broke through important Fibo barrier at $1977 (61.8% of $2080/$1810 fall), generating fresh bullish signal, which will require confirmation on weekly close above this level and open way for attack at psychological $2000 barrier.

Technical studies are in full bullish configuration on daily chart but overbought, suggesting that bulls may take a breather in coming sessions.

Consolidation in current strongly favorable conditions for gold should be limited and offer better levels to re-enter strong bullish market, with dips to find solid support at $1950 zone.

Only significant decrease in geopolitical tensions, which so far looks very unlikely, would hurt bulls and push the price lower.

Res: 1987; 1997; 2000; 2010

Sup: 1977; 1962; 1952; 1945