Gold eases after another failure above $2000 but overall picture remains bullish for now

Gold edged lower on Monday, deflated by renewed risk appetite after the Fed toned down its hawkish stance and softer than expected US labor data signaled that current policy tightening cycle is close to its end.

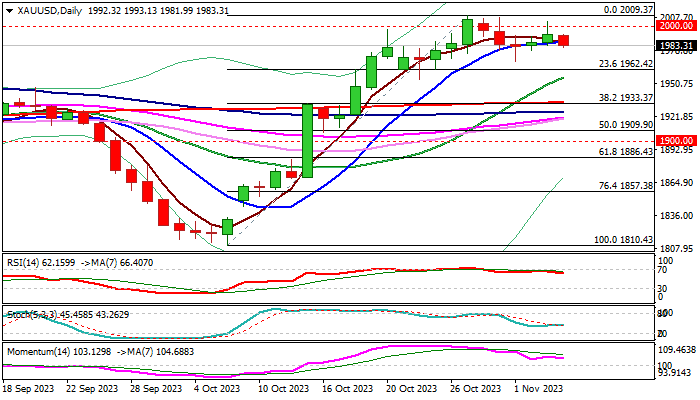

Recent multiple failure to clearly break above $2000 barrier (the metal failed to register a monthly close above psychological level six times since Aug 2020, despite several spikes which marked new historical highs), point to significance of the resistance.

Investors remain highly hesitant but stay bullish, as daily and weekly structure is positive and suggests that renewed attempts through $2000 cannot be ruled out as long as the price action stays elevated.

Extended consolidation should be ideally contained above $1962/56 (Fibo 23.6% of $1810/$2009 / rising 20DMA) to keep larger bulls intact, though deeper dips cannot be ruled out, but not to be very harmful for overall bullish picture while holding above pivotal supports at $1934/33 (200DMA / Fibo 38.2%).

Only firm break here would sideline bulls and signal deeper correction of $1810/$2009 rally).

Res: 1993; 2000; 2009; 2021

Sup: 1969; 1962; 1956; 1934