Gold eases after failing to hold gains above $1800, weighed by expectations for start of reducing stimulus and rate hike

Spot Gold eases after repeated failure to sustain gains above psychological $1800 barrier, with rising expectations that the US Federal Reserve could finally announce the start of reducing stimulus in its Nov 3 policy meeting and market participants operating with information about higher probability of rate hikes in 2022.

Reduced stimulus and higher interest rates are usually negative factors for the yellow metal, with short-term outlook also turning negative on ongoing risk-on environment.

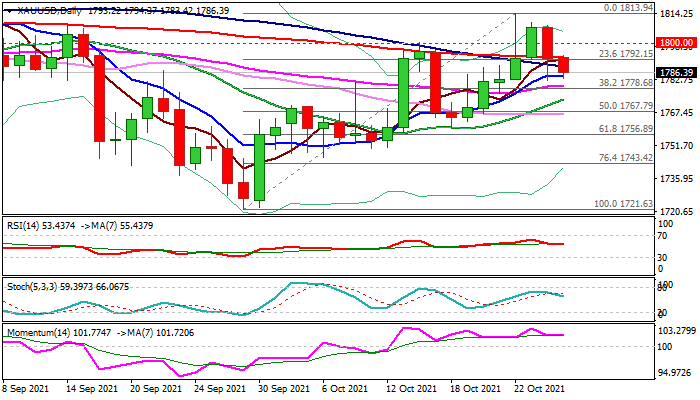

Technical studies are weakening on daily chart, as the price returned below 200-day moving average and stochastic heading south after diverged from rising price earlier.

Pivotal supports lay at $1781 (top of thinning daily Ichimoku cloud) and $1778 (Fibonacci 38.2% retracement of $1721/$1813 bull-leg), break of which would generate reversal signal and open way for extension towards next strong supports at $1760/56 (Oct 18 higher low / Fibonacci 61.8% retracement of $1721/$1813) and a higher base at $1750 zone.

Repeated weekly close below $1800 would add to negative signals, but the metal is on track for positive monthly performance after 3% drop in September.

Res: 1793; 1800; 1813; 1834

Sup: 1781; 1778; 1767; 1760