Optimistic outlook for economic growth lifts pound but the downside remains at risk

British pound regained traction and bounced from the lowest in over one week (1.3710), hit earlier today.

Optimistic tones from UK FinMin Sunak’s budget speech lifted sterling. Sunak announced stronger economic growth as the country emerges from coronavirus pandemic, saying that the economy was likely to grow by 6.5% in 2021, compared to a forecast of 4% growth, made in March, when the country was still in a lockdown.

Improved outlook comes from lifting restrictions on the economy and acceleration in Covid-19 vaccination, bringing the forecast close to the IMF’s estimate that British GDP will grow by 6.8% in 2021.

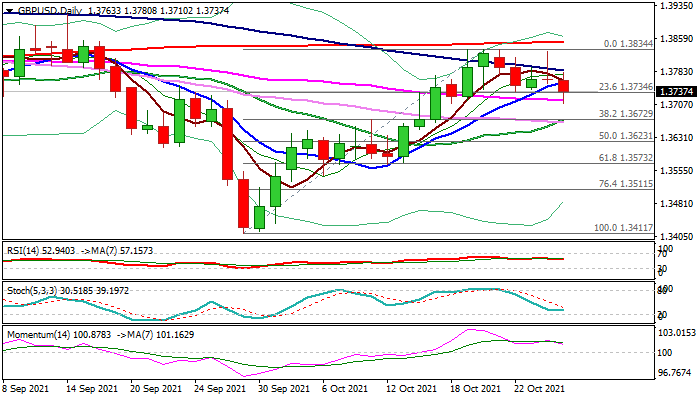

Daily studies show that cable is till in a dangerous zone, as the price action remains below thin but descending daily cloud, while daily indicators are heading south and warn of deeper pullback after the recent rally repeatedly failed under key 200DMA (1.3850).

Bearish scenario would require close below cracked 55DMA (1.3716) to generate initial negative signal, which would look for confirmation on extension and close below 1.3672 (Fibo 38.2% of 1.3411/1.3834 / 20DMA).

Conversely, lift and clos above 100DMA (1.3786) would ease downside risk and keep in play renewed attack at 200DMA.

Res: 1.3777; 1.3786; 1.3834; 1.3850

Sup: 1.3716; 1.3701; 1.3672; 1.3623