Gold eases on profit-taking but bulls remain firmly in play on strong geopolitical tensions

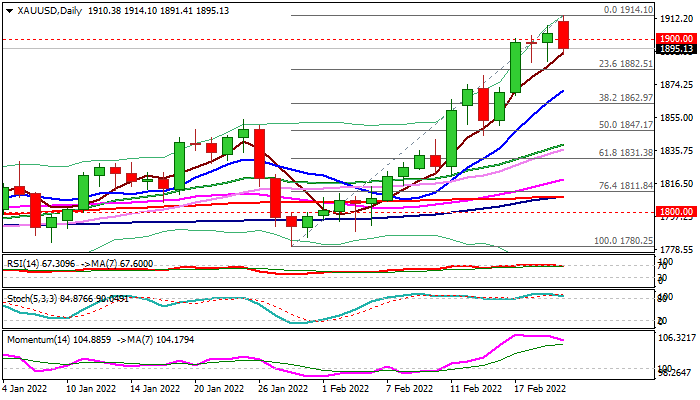

Spot gold eases below $1900 mark on Tuesday after hitting new highest since June 2021 at $1914 earlier today.

Metal’s price was deflated by higher equities despite persisting high tensions over Ukraine, as well as profit-taking, as daily indicators went deeply into overbought territory.

However, strong geopolitical tensions maintain pessimistic outlook and further escalation would quickly boost demand for safe-haven, although market participants hope that Moscow’s deployment to two breakaway regions in eastern Ukraine, will be as far as Russia goes.

Geopolitical backdrop could also slow the planned tightening cycle by major central banks that would further boost the price of the yellow metal, used as a hedge against inflation, which currently stands at a record highs in many countries.

Unless the situation drastically improves and deflates persisting fears, current price easing could be seen as a rather mild correction which would offer better opportunities to re-enter larger bullish cycle.

Initial support lays at $1882 (Fibo 23.6% of $1780/$1904 rally), followed by rising 10 DMA ($1870) and pivotal Fibo support at $1862 (38.2% retracement) loss of which would sideline bulls and signal deeper correction.

On the other side, $1900 level currently acts as initial resistance, followed by session high ($1914) and more significant $1922 level (Fibo 61.8% of $2074/$1676 fall), violation of which would unmask psychological $2000 barrier.

Res: 1900; 1914; 1922; 1927

Sup: 1882; 1870; 1867; 1862