Gold eases towards $1500 mark on fresh risk mode

Spot gold holds in red for the second straight day and dips close to important $1500 support, deflated by fresh optimism about US/China trade talks that revived risk mode.

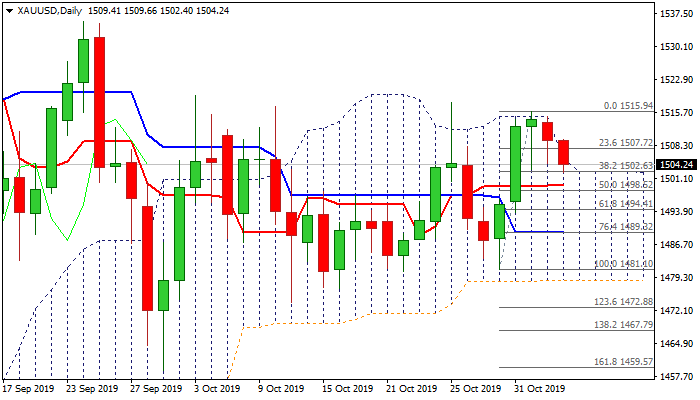

Fresh weakness emerged after last week’s strong bullish acceleration was capped by daily cloud top (1515) and cracked $1502 Fibo support (38.2% of $1481/$1515), threatening of break below psychological $1500 support (also daily Tenkan-sen) that would spark further weakness.

Fading bullish momentum and daily stochastic reversing from overbought territory add negative near-term outlook.

Close blow $1500 handle would risk extension towards $1496/94 (Fibo 61.8% / converged 20/30DMA’s), break of which would further weaken the structure and shift near-term bias to negative.

Ability to hold above $1500 would signal that fresh bears might be running out of steam and keep in play hopes for renewed attack at recent peaks at $1515/17.

Res: 1507; 1509; 1515; 1517

Sup: 1502; 1500; 1496; 1494