Gold firms at the start of the year but $4400 zone still marks significant obstacle for recovery

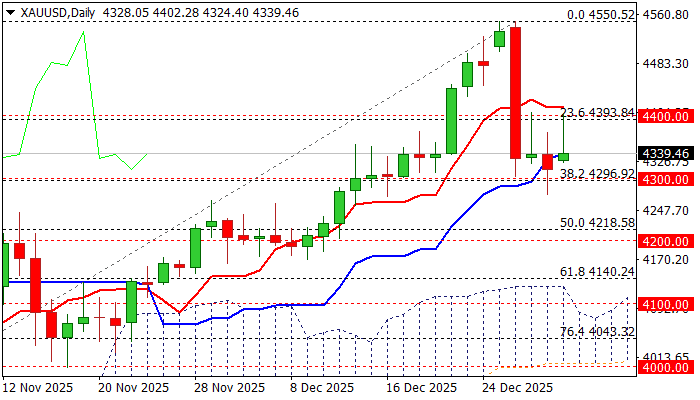

Gold started the year in positive mode, opening with small gap higher on the first trading day in 2026 and advanced to $4400 zone which marks a breakpoint and so far caps recovery attempts.

The yellow metal price fell sharply in the last days the last year, with pullback from new record high ($4550) primarily driven by year-end profit taking.

Drop of 6% on December 29, looks quite serious, but it so has far marked just a healthy correction of the upleg from $3886 (October higher low) as the close of the last trading day of the year occurred above key $4300 zone (Fibo 38.2% retracement of $3886/$4500).

However, recovery attempts still struggle at pivotal $4400 resistance, which resisted several attacks in past few sessions, with firm break here to sideline persisting downside risk and open way for stronger recovery (on completion of reversal pattern on daily chart).

Daily studies remain bullishly aligned, while more significant fundamental factors (key driver of gold price through 2025) will be closely watched by traders.

Markets expect the Fed to keep more dovish stance in 2026, while geopolitical and economic situation remain fragile and continue to fuel uncertainty that will continue to underpin demand.

Near term action is likely to remain in extended consolidation until the markets get fresh bullish signals, with deeper pullback not ruled out, as weekly and monthly studies are overbought.

Potential extended dips should find firm ground above $4000/$3800 zone (psychological / Fibo 38.2% of 2025 advance) to keep larger bulls intact and offer better levels to re-enter bullish market.

Res: 4400; 4444; 4485; 4550

Sup: 4296; 4274; 4236; 4170