Gold is on track for further gains after consolidation

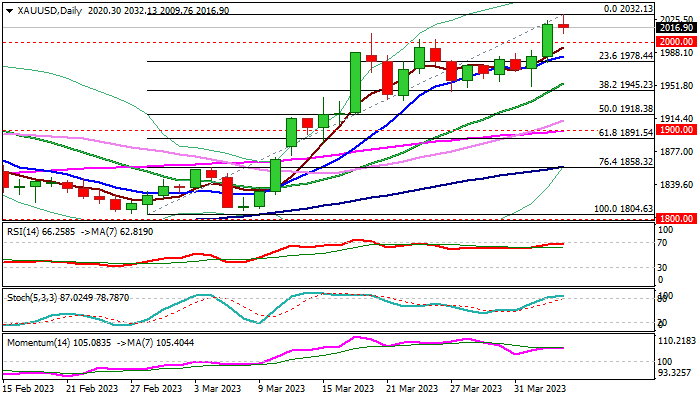

Gold hit new multi-month high ($2032) on Wednesday, in extension of Tuesday’s sharp acceleration, when metal’s price was up 1.8% for the day (the biggest daily gain since Mar 17).

Weak US data contributed to growing expectations that the Fed would significantly slow the pace of rate hikes, which sent dollar to two-month low and boosted gold price.

The latest break above psychological $2000 levels shows that environment for the yellow metal has improved, adding to chances to sustain gains above $2000, as prospect for continuation of recent Fed’s cycle of strong rate hikes has faded and uncertainty increased.

On the other hand, partial profit-taking looks logical at this point as daily studies show overbought conditions and bullish momentum is weakening.

Dips should ideally find solid ground at $2000, now reverted to support, though deeper pullback cannot be ruled out.

Rising 10DMA ($1983) marks next significant level, which should contain extended dips to keep bulls unharmed for extension towards targets at $2055 (Fibo 161.8% projection of the upleg from $1804) and record peaks at $2070/74.

Res: 2032; 2037; 2055; 2070

Sup: 2009; 2000; 1983; 1978