Gold keeps firm tone but still holding in a range and looking for fresh signals

Gold bounces back after short-lived negative reaction on OPEC’s surprise decision which temporarily inflated dollar.

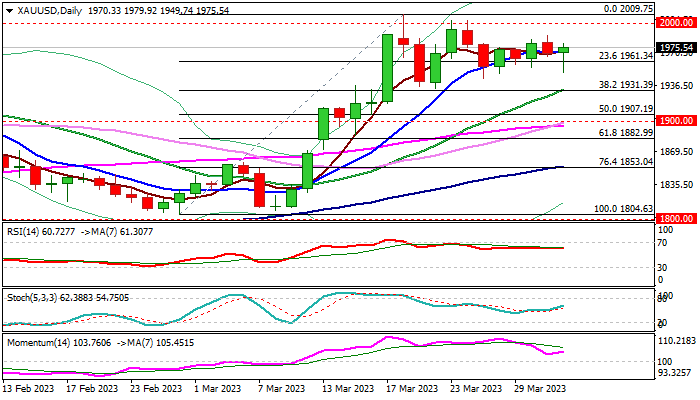

Renewed strength pushes the price back to the middle of the near-term range ($2009/$1944) established after multiple rejections above $2000, but strong bids were found at $1945/50 zone, limiting pullback and keeping larger bulls intact.

Extended consolidation with prevailing bullish bias, look as likely near-term scenario, as the metal looks for fresh direction signals.

The price remains resilient despite renewed risk appetite on fading banking fears, but may face headwinds on growing expectations for the Fed’s 0.25% rate hike in May which would hurt demand for interest-free metal.

Positive factors for gold are bullish technical studies on daily chart and a large March’s monthly candle which formed bullish engulfing pattern, as well as solid safe-haven demand on fragile global economic and geopolitical situation.

On the other hand, stubbornly high inflation increases possibilities of further rate hikes and higher terminal rate that would make dollar more attractive and add pressure on the yellow metal.

Initial supports lay at $1961/45 zone (Fibo 23.6% retracement of $1804/$2009 rally / recent range floor) followed by $1932/32 (20DMA / Fibo 38.2%) and pivotal $1907/00 zone (50% retracement / psychological) loss of which would confirm top ($2009) and signal reversal.

Conversely, firm break above $2000 barrier would generate initial signal of bullish continuation and open way for test of record highs at $2070/74).

Res: 1987; 2000; 2009; 2037

Sup: 1961; 1944; 1931; 1918