Gold loses ground, initial signal of a false break above 200DMA / psychological $1800

Gold accelerates lower on Monday, after hitting new five-month high, deflated by stronger dollar and despite the news that China, big gold consumer, is relaxing its strict Covid measures.

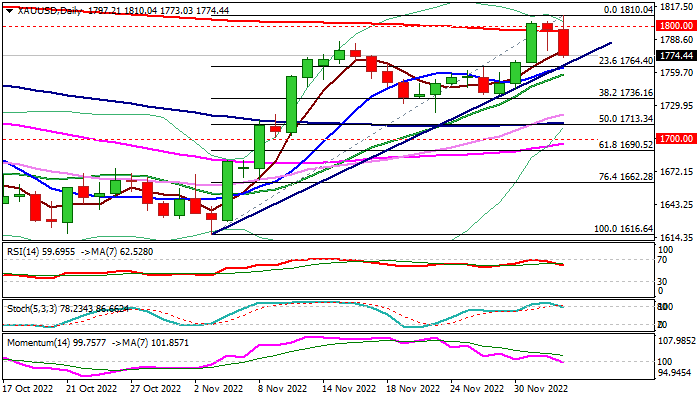

The metal lost traction after a marginal close above psychological $1800 barrier and a marginal weekly close above the nearby 200DMA ($1795).

Fresh weakness points to a false break above 200DMA / $1800 and formation of reversal pattern on daily chart, after last Friday’s Hanging Man pattern warned that bulls face strong headwinds and may run out of steam.

Technical studies are weakening on daily chart, as falling 14-d momentum is entering negative territory, stochastic is reversing from overbought zone and RSI is heading south and broke below its 7-d moving average.

Fresh bears eye initial supports at $1768 (bull-trendline), $1764 (Fibo 23.6% of $1616/$1810 / 10DMA) and $1757 (20DMA), violation of which would risk deeper pullback and expose key supports at $1736 (Fibo 38.2%) and $1723 (Nov 23 trough).

Res: 1795; 1800; 1810; 1814

Sup: 1768; 1764; 1757; 1736