Dow eases on profit taking as investors eye Fed policy meeting

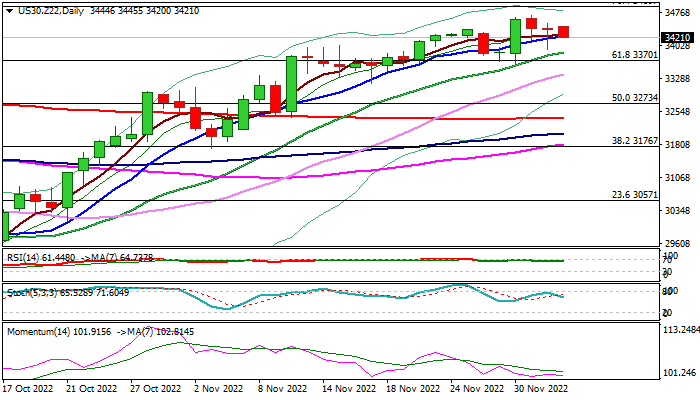

The Dow Jones is standing at the back foot on Monday and pressuring initial support at 34254 (rising 10 DMA, which resisted attacks in past two days.

Traders take some profits on strong rally in past two months, looking for more signals about Fed’s next steps on interest rates, ahead of policy meeting scheduled on Dec 13-14.

Prevailing expectations are for 50 basis points hike following a series of a jumbo hikes in the recent meetings, as Fed is likely to slow the pace of policy tightening to assess the results of the recent actions.

Inflation in the US eased in past two months, adding to initial encouraging signals that rise in consumer prices has peaked, however, markets look for more evidence about the condition of the economy, as recent aggressive rate increases boosted fears of stronger slowdown in economic growth, with growing signals that the economy would likely slide into recession next years.

The latest labor report showed fresh increase in employment, but also rise in earnings, which could fuel an inflation and add to concerns, while focus turns on report from the US services sector, after the data last week showed contraction in activity in manufacturing sector, for the first time in 2 ½ years, weighed by increased borrowing cost.

Daily studies show growing signals of pullback, as bullish momentum continues to fade and a bearish divergence on daily RSI and stochastic indicators add to negative signals.

Below 10 DMA, dips would face pivotal levels at 33870/33620 zone (20DMA / broken Fibo 61.8% of 36830/28638 / last week’s low), with firm break here to spark deeper pullback.

Res: 34705; 34897; 35277; 35409

Sup: 33874; 33621; 33372; 33281