Gold-near term bears eye key supports

Gold remains at the back foot on Thursday and holding in red for the fourth consecutive day, deflated by fading safe-haven demand as conflict in the Middle East slowed.

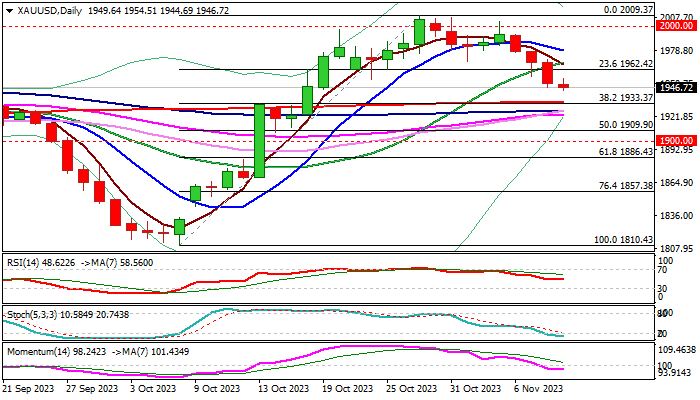

Fresh weakness adds to signals of another failure to sustain break above psychological $2000 barrier, with extended dips more likely to be seen as positioning for another attack (in current geopolitical and economic conditions which maintain demand for the yellow metal) rather than reversal, although reversal pattern is forming on weekly chart, but still looking for confirmation on break of pivotal supports at $1938/33 (weekly cloud top / Fibo 38.2% of $1810/$2009 rally, reinforced by 200DMA).

Daily studies are mixed and lack clear direction signals for now, though overbought stochastic warns that current bear-leg may face increased headwinds on approach to key supports.

Near-term action is expected to keep bearish bias while below $1962/68 (broken Fibo 23.6% level / 20DMA), with break of a cluster of supports at $1940/20) to generate fresh bearish signals and open way for possible sub-$1900 drop.

Conversely, acceleration and close above 10DMA ($1979) to sideline bears.

Res: 1954; 1962; 1968; 1979

Sup: 1938; 1933; 1921; 1909